jannoon028 | freedigitalphotos.net

A Bank BPO

REOs or real estate owned properties are typically foreclosures that the bank ended up gaining back after the home buyer defaulted on the loan. With more REOs available than ever before, it’s essential that their bank BPO values are accurate. Here is a little more information about the importance of the bank BPO and how banks manage it.

Why Banks Must Have an Accurate Bank BPO

Banks need to sell REO property as soon as possible, because the sooner they sell it, the less money they’re spending on it. These properties have to be maintained, the taxes have to be paid, etc. In order to get back as much money as possible on the home, banks must know the value of the home and property. With their Bank BPO they can accurately make counter offers in sales negotiations and get as much money as possible from the home.

Why Full Appraisals Aren’t as good as Bank BPO

In many cases, banks order full appraisals, but for REO properties, full appraisals are an unnecessary cost. Full appraisals can cost hundreds of dollars and can take weeks to get back. When an offer pops up unexpectedly for an REO property, banks need to get a quick and accurate view of the value of the home without spending a lot of money. For this reason, they often rely on a Bank BPO or Bank broker price opinion.

What is a Bank BPO?

A Bank BPO is an educated assessment of the value of a home from a licensed real estate professional. Banks can obtain BPOs much faster and for a cheaper price than a full appraisal. Real estate professionals typically formulate the assessment based on nearby listed properties, features on the property, the size of the home, the year the home was built and more. There are a few different kinds of BPOs that can be performed, depending upon what the bank wants.

Interior and Exterior Bank BPO

With an exterior Bank BPO (the most common type), the professional simply takes a good look at the exterior of the home and then uses additional information as mentioned above to create an opinion on the price. With an interior Bank BPO, there is more work involved, and the BPO typically pays the real estate professional a little more. The agent will go inside the home, look around, and they may take measurements to help determine the value of the home.

While full appraisals are sometimes needed, when it comes to an REO property, banks are more likely to order a BPO from a qualified professional. In fact, there has been such an increase in BPO orders (and an estimated 13 foreclosures per second and rising), that real estate agents have started to make a great additional income performing BPOs for various banks and financial institutions.

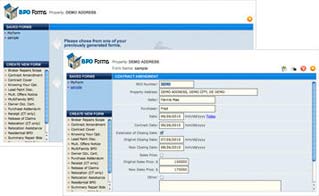

Learn more about our BPO Software or our How To Complete a BPO ebook.

To read a more detailed definition of Broker Price Opinion on wikipedia click here.