Valuations and BPOs

Unfortunately, distressed homes are on the rise; individuals are finding it more and more difficult to pay off their home loans. Therefore, homes are going into default and foreclosure, and this increases the need for banks and lenders to determine how much their homes and properties are worth. Because a full appraisal is more expensive than Valuations and BPOs, often times lenders will choose the BPO route. However, both valuations and BPOs are on the rise.

Realtors and BPOs

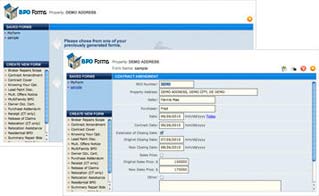

Banks and lenders hire real estate professionals to perform valuations and BPOs, or broker price opinions, on properties and homes when they want to know the value but don’t want to pay for a full appraisal. The real estate agent goes to take a quick look at the property to determine the worth, and sends a small report to the lender with the information. This allows the lender to determine what to ask when auctioning the home or when a homeowner is attempting a short sale. It’s a great way for real estate professionals to make extra money, especially if they can pick up a few BPOs a week.

What is Involved in Valuations and BPOs?

There are two different types of BPOs, an internal BPO and a drive-by BPO. For a Exterior BPO, the agent will simply drive by the property and take a look at it, and compare it to other properties for sale in the area. They will use the information they’ve gained to create a report. With the interior BPO, agents will typically go inside the home, may take measurements and photos, and then use that information to draft a report to send to the lender. BPOs typically pay between $50 and $150 each, so it’s something many real estate professionals want to take advantage of.

When are BPOs Used? Valuations and BPOs

BPOs are most commonly used when a homeowner is attempting to refinance, or when the home has gone into default and the lender is considering a foreclosure. They can also be used when the homeowner is attempting a short sale to prevent a foreclosure. Lenders utilize BPOs because they’re cheaper than a full appraisal, and the BPO is still fairly accurate, since it’s coming from real estate professionals who know the market and the current trends in the local real estate market.

Where to Get More Information

NABPOP, or the National Association of Broker Price Opinion Professionals, is a wonderful place to learn more about BPOs and to get the information needed to perform them. NABPOP can provide real estate professionals with the information they need, the tests needed to become certified to perform BPOs, and can connect them with companies who need BPOs. While the full membership price of NABPOP is about $220, the benefits are great. Real estate professionals can join a community where they’ll be informed and given resources to start BPOs and make extra money on the side. If you are looking for a book of how to complete a bpo you may want to see our book.

Overall, BPOs are a great option for real estate agents who want to make a few extra dollars, and they’re helpful for lenders who don’t want to pay for full appraisals.