Ambro | freedigitalphotos.net

What is a BPO?

The term BPO is often heard in relation to foreclosures and distressed properties, but many individuals don’t know exactly what it means. What is a BPO, or broker’s price opinion? A BPO is used by banks to determine the approximate value of a home or property, especially when it’s in foreclosure or distressed. However, it’s different from an appraisal for several different reasons. Here is some information on exactly what a BPO is and how it’s used. Wikipedia defines it a little different. What is a BPO? Wikipedia says its the process hired sales agents use to determine a selling price of real estate.

Broker’s Price Opinion

What is a BPO? Its a valuation of a property. Rather than an in-depth appraisal from a real estate professional, a BPO is a less involved, faster approximation regarding the value of a home or property. Banks often order BPOs from real estate professionals when they just need an estimate of how much a property is worth and when they want to get it back quickly. BPOs can be completed in just a few days whereas an in-depth appraisal could take several weeks.

How a BPO is Performed

What is a BPO and How are they performed? There are a few different types of broker’s price opinions, including an external BPO and an internal BPO. The latter kind is used more often, and simply involves a real estate agent driving by the property to get a good look at the exterior. The professional would then compare the property to a few other comparable properties in order to determine the approximate worth of the home. Agents may look at paperwork that lists features of the home, such as the number of bedrooms, bathrooms and the previously measured square footage.

Internal BPOs

Its tough to generalize all BPOs when answering the simple question what is a bpo. There are actually different types of BPOs. An internal BPO is very similar to the external type, except that the agent actually goes into the home and may measure it or take a look at the features to determine whether the home is outdated, etc. Usually, an internal BPO is more involved and may be a more accurate reflection of the home’s worth.

What is a BPO and Why do Banks Order BPOs

Banks order BPOs over full-blown appraisals for several different reasons. First and foremost, it’s much more cost efficient for them. A traditional appraisal can cost several hundred dollars whereas a BPO rarely costs even a hundred. It also saves the bank time because BPOs come back faster than appraisals. They’re often used before a home is foreclosed on or if the home is going to be sold in a short sale. Banks are able to obtain BPOs from virtually any licensed real estate agent while appraisals must be done by specifically qualified individuals.

Overall, BPOs are beneficial for banks in a number of different ways. Many real estate agents have started performing BPOs on the side because it’s a great way to make an additional income, and they’re not very difficult to perform.

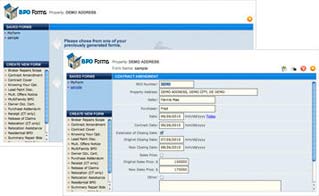

Looking for more in depth information? Below is an excerpt from our eBook How To Complete a BPO

What is a BPO from our eBook

BPO is an acronym for Broker Price Opinion. Broker Price Opinions are an easy way for a third party to get an objective opinion of value from a Real Estate Professional. A BPO typically requests multiple values from the individual performing the report, for example an as is and repaired value. A little confused? Still want to know what is a BPO? It is often commonplace to request an estimate of time required to sell a property when completing a BPO. BPO’s are most often completed for the present time, however, it is not out of the ordinary for a request for values on specific dates in the past. As the name BPO implies, Real Estate Professionals (brokers and/or agents) typically complete the reports. BPO’s are a quick and less expensive alternative to a full-blown appraisal.

Who Orders or Requests a BPO from our eBook

A BPO can be ordered by a wide array of people, however, the most common requestor of a BPO is the owner of a property or a party that has a vested interest in a property. Banks, Mortgage note holders and Mortgage Insurance Companies are the most common parties requesting BPO’s. Often times they have taken back a property through foreclosure and want to get an unbiased opinion of the current property value. Banks often order a BPO when reviewing proposed offers for short sales. A short sale is transaction where the bank agrees to sell the property for less then what is currently owed to them on the mortgage. If the bank believes that the mortgagor may default on their loan or that the cost to foreclose and then sell the home is greater than the loss of selling the home at the with the short sale value, the bank will typically accept a short sale. During the approval process the bank employs Real Estate Professionals to provide an independent third party opinion of the current market value to assist in negotiating an offer they have received on a home. The bank wants to ensure the offer is for at least a fair market value.

In addition to banks or note holders, there are often estate liquidations, bankruptcy valuations, divorce settlements and a myriad of other reasons that a property owner may want to receive a third party unbiased opinion of the market value of a home. A BPO is a commonly used simple tool to get this value.

With all of these potential sources of BPO business now is as good a time as any to get started performing for fee BPO’s.

What is a BPO vs Appraisal

You may wonder what is a BPO and what is the difference between an Appraisal? Why wouldn’t people just hire an appraiser to get a valuation of the property. Appraisals are the industry standard when underwriting new loans on purchases and refinances, but in light of the dramatic increase in mortgage defaults, BPOs have become extremely popular. The cost of a BPO can range depending on whether the property is Residential or commercial, whether it’s rural or easily accessible, and whether the Broker is doing an interior or exterior BPO. (More on that later) Regardless of the variations in costs of different types of BPOs, they are generally speaking far less expensive ranging from $40 – $300 or so based on the factors previously mentioned. Most appraisals will begin at $250 and can go as high as $5000 based on those same factors.

Appraisers are often guided by strict guidelines and state mandated rules that do make an appraisal more thorough and more regulated. Whether this results in a more accurate valuation or just a more regulated one is up for debate. Appraisals often take longer to complete and generally in the range of a week, BPOs are often ordered and returned in 3 to 4 days. With the increased cost and often longer deliver timeframes, Banks and other interested parties have started putting more focus on BPOs as opposed to Appraisals in many situations. Ordering a BPO often allows them to get a quick opinion of market value multiple times over the course of 6 months. Given the higher cost of an appraisal a BPO is often the best choice to keep an eye on the change in value and market conditions.

Are you still perplexed about exactly what is a BPO? Our complete step by step guide to Broker Price Opinions will help.